Where is China catching up with semiconductors?

From smart phones, medical equipment to national defense and military industry, semiconductors are needed. At present, the semiconductor industry has become a national strategic struggle, and the struggle for the dominant position of the semiconductor industry is evolving into a game similar to the conflict between several big countries competing with each other in the 19th century for the control of Central Asia. However, today, this modern game mainly focuses on enhancing industrial capacity and developing the latest technology.

Although, under the current global industrial chain and supply chain system, especially in the smart phone market, China has formed a complete electronic product manufacturing industry chain. However, for the three types of Companies in the semiconductor industry, Chinese enterprises still play the role of rule followers. Under the continuous technological blockade of the United States, where has China's semiconductor catch-up road come now?

American monopoly

The semiconductor industry has many links and a high degree of professional division of labor. The innovative application of technology is an important driving force of the industry. Specifically, the upstream and downstream of the semiconductor industry chain includes three links: IC design, wafer manufacturing and processing, packaging testing and application.

Among them, IC design refers to selecting and combining from various levels such as system, module and circuit according to the requirements of terminal products, determining the device structure and process scheme, realizing relevant functional and performance requirements, and entrusting it to the wafer foundry for production and processing; The wafer manufacturer makes the mask according to the design layout to form a template, mass manufactures the integrated circuit on the wafer, and finally transplants the circuit diagram designed by the IC design company to the wafer through repeated use of doping, deposition, lithography and other processes; The finished wafers are then sent to the downstream packaging and testing plant for cutting, wire welding and plastic packaging to prevent physical damage or chemical corrosion. At the same time, the chip circuit is electrically connected with external devices, and finally handed over to the downstream manufacturer.

At present, the semiconductor industry chain is actually a monopoly model dominated by the United States. The U.S. semiconductor industry accounts for almost half of the global market share, although in the 1980s, the U.S. semiconductor industry suffered significant losses in the global market share. In the early 1980s, US based manufacturers accounted for more than 50% of global semiconductor sales. However, due to the fierce competition from Japanese companies, the impact of illegal "dumping" and the serious industrial recession from 1985 to 1986, the US semiconductor industry lost 19 global market shares and ceded the leading position of global market share to Japan.

However, in the next 10 years, the US semiconductor industry began to rebound. By 1997, it regained its leading position with more than 50% of the global market share, which has been maintained to this day. American semiconductor companies have maintained a competitive advantage in microprocessors and other leading equipment, and continue to maintain a leading position in other product fields. In addition, American semiconductor companies maintain a leading position in R & D, design and process technology.

According to the report of the American Semiconductor Association SIA 2020factbook, American companies had the largest market share in 2019, reaching 47%. Industries in other countries or regions account for 5% to 19% of the global market; American semiconductor companies account for about 81% of the total semiconductor wafer manufacturing capacity; In addition, semiconductor companies in the Asia Pacific region account for most of the remaining capacity of the United States, about 10%. About 44% of us semiconductor semiconductor capacity is located in the US, followed by Singapore, China, Taiwan, Europe and Japan.

Of course, the global leadership of the US semiconductor industry is inseparable from technological breakthroughs and product innovation brought by large-scale R & D investment. Semiconductors are highly complex products produced by highly advanced manufacturing processes, and these breakthroughs require years of sustained huge capital and talent investment. The US semiconductor industry has always focused on R & D, and high investment has brought technological leadership. The leading position of technology has enabled us companies to establish a virtuous circle of innovation.

After all, in the past 20 years, the annual R & D expenditure (as a percentage of sales) in the United States has exceeded 10%. This ratio is unprecedented in the major manufacturing sectors of the U.S. economy. According to the ranking of EU Industrial R & D investment in 2019, in terms of the proportion of R & D expenditure in sales, the US semiconductor industry is second only to the US pharmaceutical and biotechnology industries. Obviously, R & D expenditure is very important for the competitive position of semiconductor companies. The rapid development of technological change also requires the continuous progress of process technology and equipment functions.

The resulting monopoly of the United States in the global semiconductor industry is obvious. The United States not only has the monopoly of core technology, but also controls the global industrial chain. When the United States and its partner countries include some key materials and production equipment in the control list, it naturally endangers the safety of China's semiconductor industry and related industrial systems.

China's catch-up

Compared with the current advanced semiconductor industry in the United States, China is still accelerating its catch-up in the semiconductor industry. After all, when the United States establishes its global leading position in semiconductors from the perspectives of legislation, industrial policy, direct intervention and trade war, China is deeply in motion.

If we say that in the 1960s, China gained a lot by fully investing in "two bombs and one satellite"; Then, the neglect of semiconductors in the 1970s made China lose a lot.

In the 1970s, China and the United States and China and Japan successively normalized their diplomatic relations. In the early 1970s, China introduced seven production lines from Japan. Although it had equipment, its technology and software capabilities did not keep up, so the effect was poor. In the late 1970s, the US industrial upgrading, China introduced obsolete second-hand equipment and formed 24 production lines, but it also failed to meet expectations because its technology and software capabilities could not keep up. Coupled with the national blockade at that time, matters involving the introduction of Western technology were often labeled as "crawling" and criticized and knocked down. In such a closed environment, China naturally missed a good opportunity for development.

The world semiconductor industry is changing with each passing day. When China returns to the world again, it has fallen behind for 20-30 years. According to Wang Shouwu, a microelectronics expert, in 1977, there were more than 600 semiconductor production plants in China, and the total amount of integrated circuits produced in one year was only one tenth of the monthly output of a large factory in Japan.

Although the national projects 531 and 908 came one after another soon, the 531 with the goal of "popularizing 5nm, developing 3nm and tackling 1nm" finally "introduced equipment, but could not digest technology and management". The greater reason for this failure is that China's semiconductor talents are in short supply during the ten-year movement. Even if it is clear that software and management are more important, it is difficult for a skillful woman to make bricks without rice.

The failure of 908 is another typical example. 908 project has been approved for 2 years, demonstrated for 3 years and built for 2 years. Seven years later, Huajing factory fell behind as soon as it was put into operation. It not only lags behind the advanced technology for 4-5 generations, but also has only a mere 800 pieces of monthly production capacity, less than a Chengdu with a target production capacity of 12000 pieces. In the face of heavy bank interest, Huajing was finally acquired by the central enterprise China Resources and became the current China Resources Microelectronics after twists and turns.

Despite the fact that China has spent tens of billions of dollars trying to stand out in the competition for semiconductors, faster computers and smartphones, and more sophisticated devices, China's semiconductors still have a long way to catch up.

The low localization rate of core chips is an indisputable fact. Although China has achieved partial import substitution of domestic chips in communication equipment, and the proportion of Chinese chips in application processor and communication processor has reached 18% and 22% respectively, the domestic core chip market in memory equipment and display system has just started, and on the terminal core chip of computer system and general electronic system, The market share of domestic chips is even close to 0.

More importantly, China is almost blank in key categories. In other words, China still lacks the production capacity of high-end chips. It can be said that it is difficult for us to meet the manufacturing needs of more high-end chips at present, from designing software to manufacturing various parts of chips, as well as photoresist and special gas required in the process of chip manufacturing.

Taking the lithography machine required for chip production as an example, our current industrial chain technology is still difficult to support the lithography technology for mass production of 5nm chips, let alone the exploration in the direction of 2nm. Even the chip production technology of SMIC, China's main force, is still a generation away from the international chip giants. At present, the core energy is produced at 7Nm, but 5nm is widely used internationally.

In addition, the essence of lithography machine is the problem of global industrial chain. There are more than 100000 parts in a top-end EUV lithography machine, with more than 5000 suppliers worldwide. The composition of vacuum lithography system in the Netherlands and Japan accounted for 27%, and the composition of vacuum lithography system in the United Kingdom and Japan accounted for 27%. Lithography machine is the crystallization of globalization. It is unrealistic for a country or region to make a lithography machine.

Therefore, the research and development of lithography machine can not become the only goal. In the game of big countries, building a complete industrial chain of semiconductors is the core. Obviously, at present, China is still restricted by the whole semiconductor industry chain. Moreover, under such circumstances, the U.S. government has successively taken measures to include Huawei, SMIC international, Godson and other domestic enterprises in the entity list and suppress them, which has continuously hindered the development of China's semiconductor industry.

In addition, memory (Samsung, Hynix, micron) should rely on people's nose; Programmable logic chip (FPGA) is basically monopolized by Intel and Xilinx; IGBT, DSP, CPU, GPU, MCU, semiconductor equipment, silicon chip and so on are also imported.

It is imperative to catch up from behind

It is undeniable that China has lagged behind the United States in chip technology for many years. It may take a long time to fully catch up. After all, the cost of process R & D is progressive, but the reality is not so pessimistic. After all, relying on national strength, unifying the direction and catching up from behind is China's incomparable great advantage.

Such as the panel industry. Just five years ago, "lack of screen and less core" was a common reality. Panels are commodities with an annual import of more than US $50 billion, like auto parts, chips and oil. In 2010, especially China's Taiwan suppliers, Japan and South Korea brand collective price increases. However, just after that, BOE spent a total of 300 billion, made losses and investments in turn, and finally ushered in a return. It not only forced Japan and South Korea to close the low generation production line and drive Taiwan enterprises out of the market, but also made profits after years of losses.

In terms of the current development status of the semiconductor industry, we should not only invest funds and talents in the top-level design to support the development of the semiconductor industry, but also reform the system and mechanism. Support high-end scientific and technological talents to carry out industry university research cooperation, or support high-end scientific and technological talents to start businesses with technology, and allow them to carry out inclusive trial and error on a larger scale in a more market-oriented way.

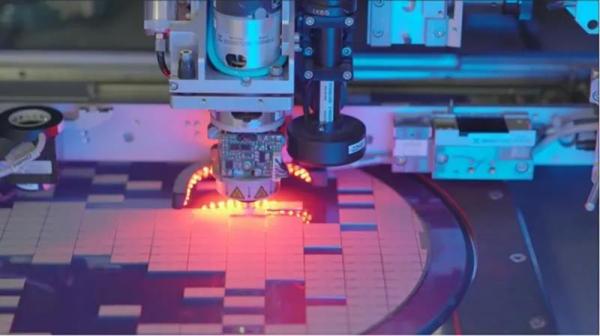

Because the technological upgrading of the semiconductor industry is an investment of major capital expenditure, which is accumulated by huge funds. In fact, just after ZTE was sanctioned, SMIC international purchased an extreme ultraviolet lithography from ASML, the world's top lithography manufacturer, at a staggering price of $120 million. The price of only one lithography machine exceeds the profit of SMIC in one year.

Moreover, this is only one equipment, not the whole production line. In addition to the lithography machine, a production line also needs etching machine, film deposition equipment, single crystal furnace, CVD, developer, ion implantation machine, CMP polishing machine, etc. When calculating the cost, remember to include 20% of the annual maintenance cost, or not, because if you want to stay at the forefront of the team, you need to update it basically every year.

For another example, BYD semiconductor and Huahong semiconductor, which are in the second echelon of China's semiconductor industry, are still 2-3 generations away from SMIC in terms of mass production chip technology. If these enterprises want to upgrade to SMIC's 7Nm mass production technology, they will face huge capital expenditure - now the investment in the mainstream 14nm or 7Nm chip manufacturing production line in the industry starts with 50 billion yuan, and Samsung and TSMC have invested more than 20 billion dollars in the 7Nm production plant. The current profits of BYD semiconductor and Huahong semiconductor are obviously difficult to support this investment, so they naturally fall into a dilemma.

The semiconductor industry is a well deserved "money crusher", so. In order to make effective use of financial, talent and social resources, it is urgent to do a good job in top-level design and optimize the layout, select enterprises and institutions with industrial technology and resource advantages, and provide key financial support and policy support. Promote leading enterprises and institutions to promote industrial "chain agglomeration" through technology, management and business model innovation.

On the one hand, give play to the leading and exemplary role of leading backbone enterprises in independent innovation and industrial development, form R & D and brand advantages, and finally consolidate and form a national semiconductor technology, talent and industrial highland with reasonable regional layout and obvious industrial advantages. For example, build national pilot platforms for software and hardware, single crystal growth and epitaxy, chip technology and packaging for universities, scientific research institutes and start-ups, build OEM plants with advanced technology and operation level, and promote the construction of vertical integrated manufacturing enterprises with independent and controllable ability.

On the other hand, if the United States continues to block our chip technology, in addition to relying on our own technological breakthroughs, we can try to cooperate with the EU, introduce EU chip technology, or cooperate with EU manufacturers. Encourage domestic powerful enterprises and scientific research institutions to set up Semiconductor R & D institutions abroad, and carry out R & D cooperation with foreign semiconductor enterprises and scientific research institutions. Support domestic enterprises and institutions to acquire overseas semiconductor enterprises, actively participate in international technology and industrial alliances, expand international cooperation channels, improve the ability of international resource integration and realize international operation.

In the short run, China's semiconductor strategy focuses on reducing its dependence on the United States. In the long run, China's huge investment in chip manufacturing will eventually return, and it is only a matter of time. But before the day of transcendence comes, maybe we should work harder to shorten this time.